georgia estate tax rate 2020

Taxpayers reach their highest tax bracket once they reach an income of 7000 for single filers and. Information about Property Taxes Millage Rates and Car Tags.

Property Taxes Laurens County Ga

Property is taxed according to millage rates assessed by different government entities.

. We dont make judgments or prescribe specific policies. County Property Tax Facts. The highest marginal tax rate in the state at 575.

Property Tax Homestead Exemptions. While the state sets a minimal property tax rate each county and municipality sets its own rate. Does Georgia have an estate tax.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158. DEC 20 2020. See what makes us different.

Looking at the tax rate and tax brackets shown in the tables above for Georgia we can see that Georgia collects individual income taxes. Georgia Property Tax Rates. In Gwinnett County these normally include county county bond the detention center.

That number is used to calculate the size of the credit against estate tax. Pay Property Taxes Property taxes are paid annually in the county where the property is located. The Estate Tax is a tax on your right to transfer property at your death.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Federal estate tax rates for 2022. The assessed value 40 percent of the fair market value of a house that is worth 100000 is 40000.

Counties in Georgia collect an average of 083 of a propertys assesed fair. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

They are very different organizations. In a county where the millage rate is 25 mills the property tax on. Get information on how the estate tax may apply to your taxable estate at your death.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. Estate Tax - FAQ. Information about and links to both the Tax Commissioner and Tax Assessors Office.

Property Tax Returns and Payment. Georgias income tax rates range from 100 percent to 575 percent. Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every.

How to Figure Tax. It consists of an accounting of. 2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier.

That number is used to calculate the size of. Georgia Tax Brackets 2022 - 2023. To successfully complete the form you must download and use.

Georgia estate tax rate 2020. Overview of Georgia Taxes. Georgia law is similar to federal law.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Property Taxes in Georgia. GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County.

Georgia income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31. 48-12-1 was added to read as follows.

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

State Death Tax Hikes Loom Where Not To Die In 2021

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Estate Tax In The United States Wikipedia

Does Georgia Have Inheritance Tax

How Do Millionaires And Billionaires Avoid Estate Taxes

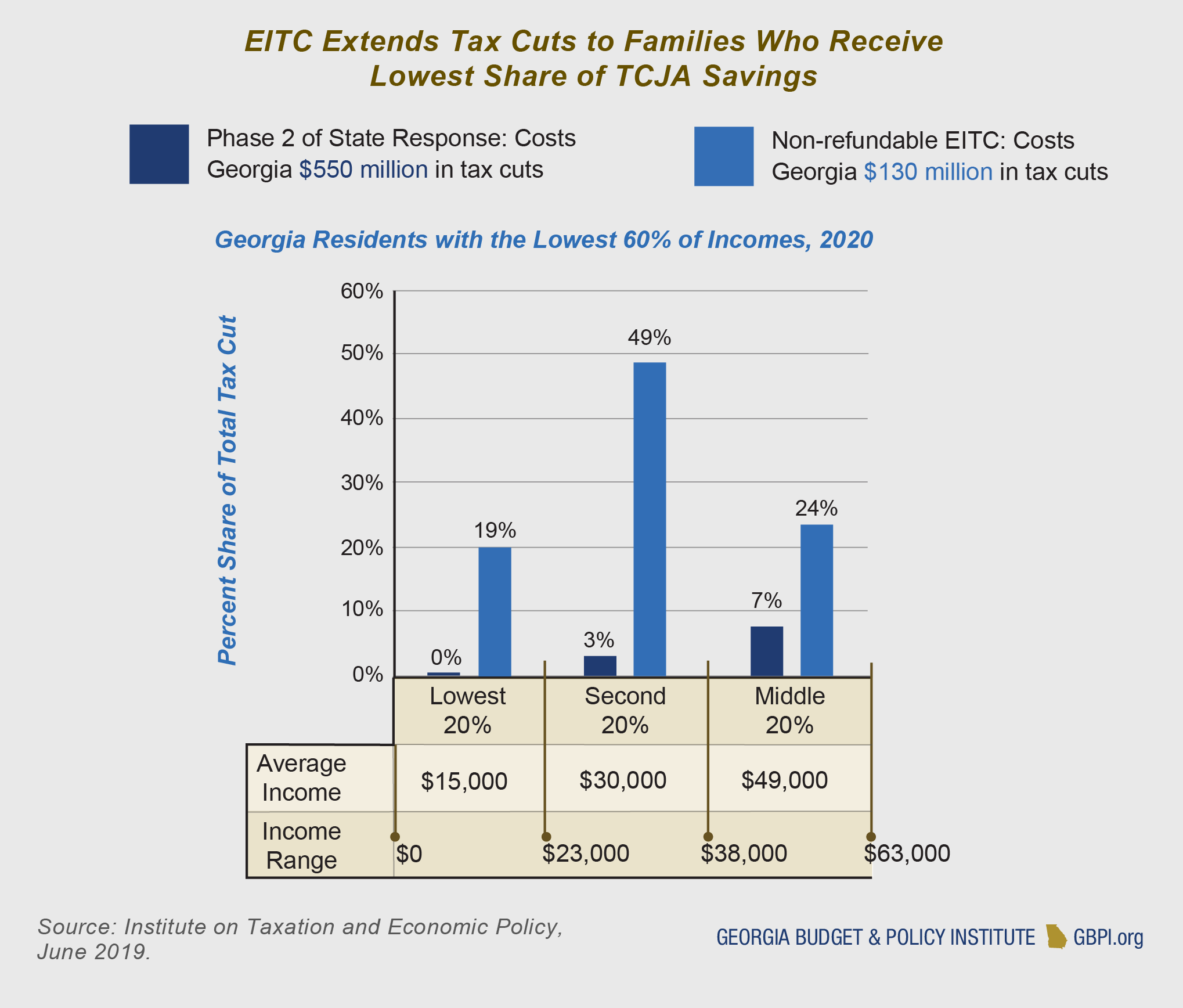

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

Dc Lowers Estate Tax Exemption To 4 Million Royal Law Firm Pllc

Where Not To Die In 2022 The Greediest Death Tax States

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

State Tax Levels In The United States Wikipedia

New York Tax Rates Rankings New York State Taxes Tax Foundation

Free Georgia Bill Of Sale Forms 4 Pdf Eforms

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center